Industry-Leading Risk and Resilience Solution Builds Context, Capability, and Connectivity Through Engagement

SYDNEY, NSW AND TYSONS, Va., June 26, 2023 – iluminr is proud to announce the implementation of its industry-leading risk and resilience solution with PenFed Credit Union, one of America’s largest credit unions with $35.3 billion in assets and nearly 3 million members. This strategic partnership enables PenFed to foster business agility by building context, capability, and connectivity throughout the organization, ensuring robust business and organizational resiliency and enhanced risk management.

With iluminr’s cutting-edge technology platform, PenFed gains a comprehensive risk and resilience solution that empowers them to navigate the dynamic landscape of resiliency related threats and challenges. By implementing this industry-leading technology, PenFed brings business agility to the forefront, enabling effective business resiliency risk assessment, organizational preparedness, and response.

“At PenFed, we understand the importance of staying ahead in an ever-evolving environment. Our partnership with iluminr and the implementation of their risk solution for business resiliency management, if delivered as promised, will allow us to proactively address risks, build organizational capability, and foster connectivity across teams,”

said PenFed Senior Vice President of Global Fixed Assets Terry Williams. “I’ve looked at a number of platforms and iluminr’s innovative platform has great potential and looks to bring our vision for greater business resiliency and agility to life, providing us with the tools and insights we need to successfully navigate challenges and better maximize opportunities.”

iluminr’s solution goes beyond traditional risk management approaches by fostering engagement and collaboration throughout the organization. By building adaptive context through a combination of real-time systems integration and people-powered insight, PenFed looks to gain a holistic understanding of potential business resiliency risks, enabling them to make quicker informed decisions and take proactive measures to mitigate threats. This context-driven approach strengthens risk assessment processes and empowers the organization to respond swiftly and effectively to fast-moving change, inherent in manmade and natural disasters and incidents.

“PenFed recognizes that resilience is not just about managing risks but also about building capability and fostering connectivity across the organization,”

explained iluminr CEO and Co-founder Josh Shields. “Our solution is designed to empower teams, promote engagement, and provide the necessary tools to navigate business resiliency risks and drive business agility.”

Through iluminr’s gamified, engagement-focused platform, PenFed hopes to enhance its capability to respond to any situation by offering comprehensive training, simulations, and scenario-based exercises. Through 15-minute bite-sized, immersive exercises, teams build muscle memory, skills, and the knowledge required to effectively manage and overcome risks and disruption. The solution should enable seamless collaboration and knowledge sharing by fostering connectivity across teams, further enhancing the organization’s overall resilience.

“As an industry-leading provider of risk and resilience solutions, iluminr aligns perfectly with PenFed’s commitment to innovation and excellence,” added Williams. “They have approached business resiliency and risk management with a unique methodology that has impressed us. It’s user-friendly for both front and back-office staff. We haven’t seen another platform like it. Together, we are bringing business agility to life, equipping our organization with the context, capability, and connectivity needed to thrive in today’s rapidly changing landscape.”

About PenFed Credit Union

Established in 1935, Pentagon Federal Credit Union (PenFed) is America’s second-largest federal credit union, serving 2.9 million members worldwide with $35.3 billion in assets. PenFed Credit Union offers market-leading certificates, checking, credit cards, personal loans, mortgages, auto loans, student loans, and a wide range of other financial services with members’ interests always in mind. PenFed Credit Union is federally insured by the NCUA and is an Equal Housing Lender. To learn more about PenFed Credit Union, visit PenFed.org

About iluminr

Bring resilience to life with iluminr. iluminr’s cloud-based platform supercharges engagement in risk awareness and resilience, streamlines preparedness, and empowers agility so teams can thrive through fast-paced change, leveraging:

Microsimulations – Drawing on years of annual simulation experience, iluminr’s award-winning Microsimulations take all the best components of traditional tabletop exercises, distilling them into 15-minute digital simulations. These short experiences create “aha” moments, subsequently increasing stakeholder engagement and bolstering preparedness. Because Microsimulations are short and delivered digitally, they can be integrated into regular operations – helping organizations build muscle memory in response capability throughout the year, all while addressing regulatory requirements.

Mass Notifications – Protect people and operations with lightning-fast emergency notifications delivered via channels they use every day. iluminr’s communications module is so simple to use, there’s no training required. The module also offers turnkey integrations to ensure all your communications reach the right people at the right time, and an interactive communications dashboard displaying status updates, polling results, and responses in real-time.

Critical Event Management Rooms – Turn data into actionable insights to support better decision-making during an event. Access continuity and response plans, conduct incident assessments, collaborate and manage the event on digital whiteboards, and activate teams through automated playbooks delivered wherever their team members are, including Microsoft Teams and Slack.

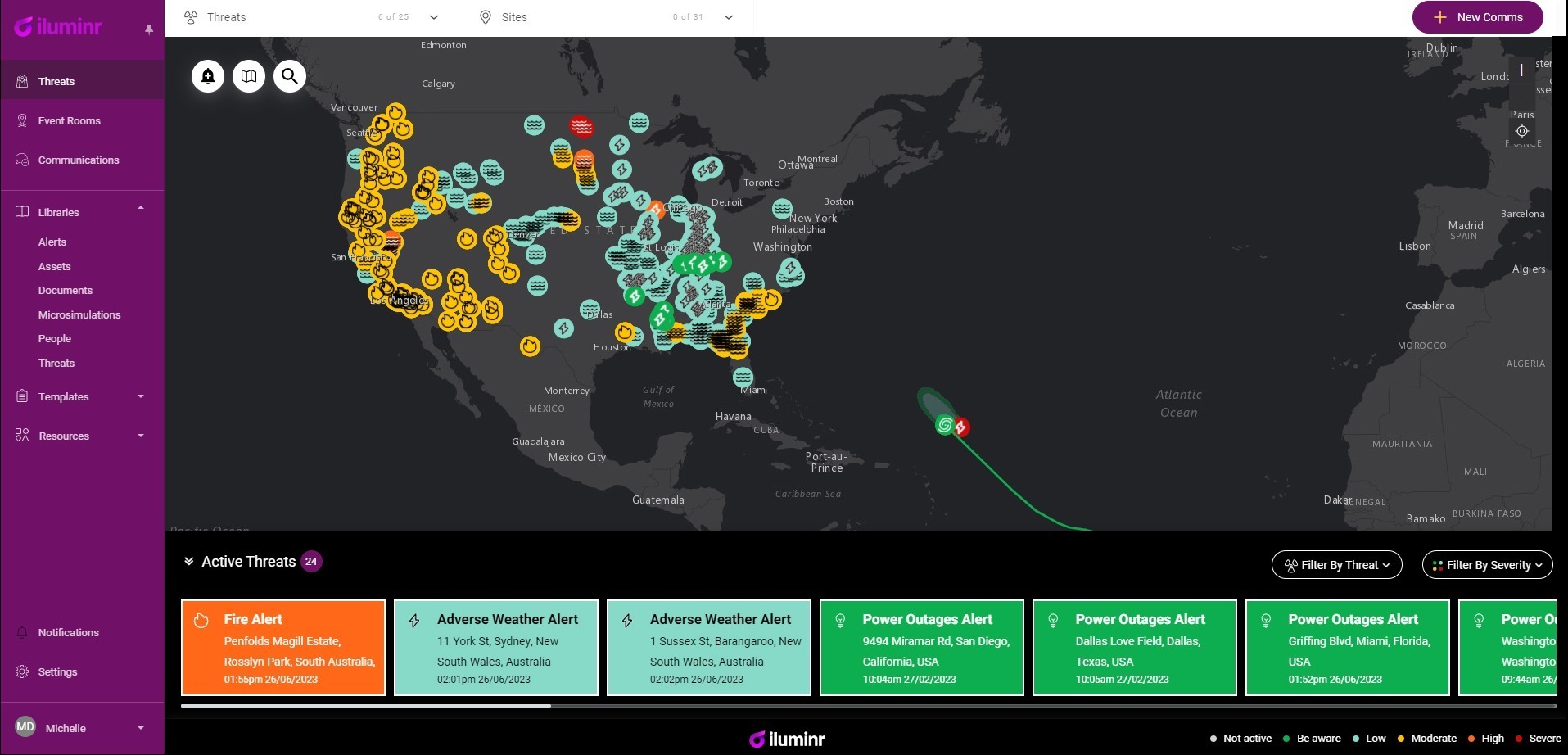

Threat Intelligence – Through global threat monitoring and automated alerts for events such as floods, extreme temperatures, or power outages, organizations can proactively communicate with key stakeholders and get ahead of any situation before it escalates into a full-blown disaster

To learn more iluminr’s Risk and Resilience solution, please visit iluminr.io

Media Contact:

Paula Fontana

VP, Global Marketing, iluminr

paula.fontana@iluminr.io