Staying Ahead of the Game

In today’s rapidly changing world, financial services and insurance institutions are facing an unprecedented level of uncertainty and disruption. To stay ahead of the game, organizations must be agile and resilient, with the ability to quickly adapt to new circumstances and mitigate risks.

Risk management plays a crucial role. By identifying potential threats and vulnerabilities, organizations can develop strategies to prevent or minimize their impact. However, risk management should not be a one-time exercise. Rather, it is an ongoing process that requires constant vigilance and adaptation.

Business agility is the key to staying ahead of the game. This involves constantly assessing the operating environment, modifying processes as conditions change, and empowering people to make quick, informed decisions. Agility also requires a cultural shift within the organization, with a focus on context, capability, and connectivity.

By adopting a proactive approach to risk management and business agility, organizations can gain a competitive advantage and be better prepared to handle unexpected challenges. This includes investing in data and technologies that can help to simplify the work of agility-building and engage the entire organization in the process.

Creating Clarity and Confidence

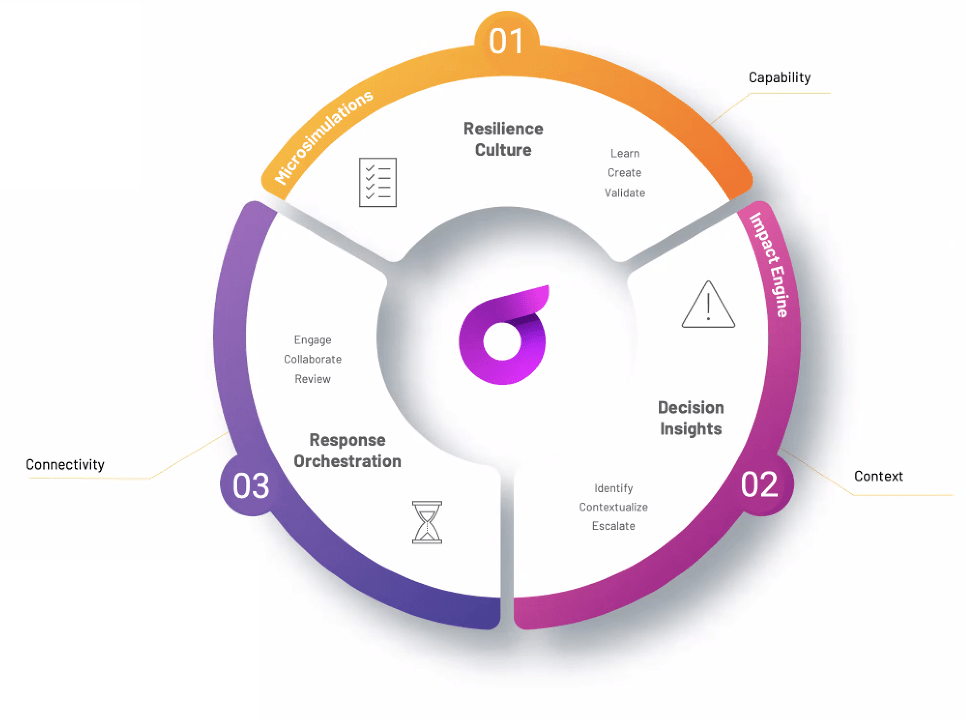

The 3 Cs of Agility

In today’s fast-paced and complex business world, it’s crucial to have clarity and confidence in decision-making. But how can you achieve this when you’re dealing with various stakeholders, data, and situations? The answer is by focusing on three Cs: context, capability, and connectivity.

To create clarity, you need to understand the Context. Gathering this information requires research and analysis, which can be time-consuming, but it’s essential to have a clear understanding of the context before making any decisions.

Having clarity alone is not enough. You also need to have the capability to execute your decisions effectively. Capability

in this way can refer to people, processes, or assets. Evaluating your capability involves assessing your team’s strengths and weaknesses, as well as identifying any gaps in resources and infrastructure.

Effective Connectivity ensures that everyone is aligned with the goals and objectives, and everyone understands their roles and responsibilities. It also enables you to receive feedback, identify potential issues, and make necessary adjustments.

Context

Relevant information and factors that impact your decision-making

Capability

Skills, knowledge, and insights required to implement your plans.

Connectivity

Effective communication and collaboration channels with your team, stakeholders, and customers.

Threat Intelligence:

The Offensive and Defensive Line

Context is increasingly important in protracted uncertainty, and it expands beyond the immediate horizons of your firm’s business operations. Fortunately, with advances in data, understanding what is going on inside and outside of your organization has never been more accessible or economical. However, this information often gets siloed, accessible only by specific teams and unanchored to business context.

Engaging the wider organization becomes crucial. By empowering all employees to identify, understand, and report potential threats, organizations can significantly increase their threat intelligence capabilities.

In fact, a study by the Ponemon Institute found that organizations with a strong risk culture, where all employees are engaged in threat intelligence, had an average cost savings of 58%1 per data breach incident. Moreover, a report by Accenture found that organizations with the highest levels of employee engagement in threat intelligence had a 31% lower likelihood of experiencing a security breach compared to those with the lowest levels of engagement.

It’s important to recognize that threat intelligence is not a one-time exercise. It requires continuous monitoring and analysis of the threat landscape to ensure that the organization is equipped to respond quickly and effectively to emerging threats.

Engaging the whole of the organization in threat intelligence gathering can also help to establish a culture of security awareness and risk management. By encouraging employees to be vigilant and proactive in identifying potential threats, organizations can create a sense of shared responsibility for risk management.

Wargaming and Simulation:

The Muscle Memory for Agility

As risk management leaders, we are constantly seeking ways to increase resilience and adaptability in the face of a rapidly changing environment. One powerful tool for achieving this is deliberate practice, a concept developed by psychologist Anders Ericsson that has been widely applied in fields such as sports and music.

Deliberate practice involves focused, structured training with the goal of developing capability. It is not simply going through the motions of practicing, but rather involves identifying weaknesses and intentionally addressing them. This type of practice must be intentional, as it requires stepping outside of one’s comfort zone and pushing limits.

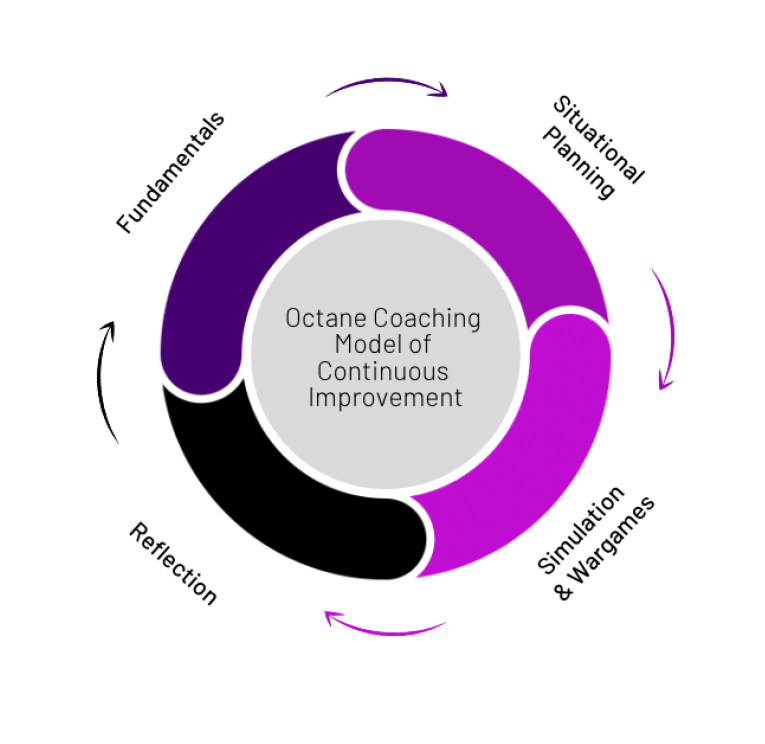

The High Octane Model is a framework for applying deliberate practice in the business world. It consists of five key components: Focus, Feedback, Challenge, Support, and Accountability.

Focus involves identifying the specific skills or abilities that need improvement and setting clear goals for improvement.

Feedback allows for continuous improvement and adjustment of training methods.

Challenge gradually raises difficulty to increase proficiency over time.

Support acts as the scaffolding for learning.

Accountability ensures that progress is being made and goals are being met.

One of the key benefits of deliberate practice and the High Octane Model of coaching is the increased engagement in the pursuit of greater risk-awareness and resilience.

By identifying specific areas of weakness and providing focused training and support, organizations can create a culture of continuous improvement and adaptability.

This type of engagement not only improves individual performance, but also strengthens the organization as a whole. Research has shown organizations that embrace deliberate practice and the High Octane Model are more likely to be resilient and adaptable in the face of challenges. For example, a study by McKinsey & Company found companies that consistently invest in building capabilities through deliberate practice are more likely to achieve their strategic goals and out perform their peers.3

By focusing on specific areas of weakness, providing feedback and support, and continually challenging oneself, organizations can increase resilience and adaptability.

Response Playbooks:

Always Gameday Ready

In the fast-paced world of risk management, being prepared for anything is crucial. Embedded dynamic risk streaming and adaptive playbooks offer a solution that can help risk management leaders stay ahead of fast-moving change.

Dynamic risk streaming is a process of continuously monitoring and analyzing potential risks and threats to an organization in real-time, integrated into how teams work. This approach empowers teams to quickly identify emerging threats and make proactive decisions on how to mitigate them.

Adaptive playbooks take this a step further by providing a flexible framework for risk that can be adjusted as needed, ensuring a response in line with a dynamic view of risk tolerance, critical steps are not missed, and regulations and standards are followed.

One of the key advantages of dynamic risk streaming and adaptive playbooks is that they allow for greater engagement and collaboration within an organization.

By involving stakeholders from across the organization in the risk management process in a way that is personalized to their role, organizations can gain a more comprehensive understanding of potential risks and develop more effective mitigation strategies.

Although the concept of risk streaming and adaptive response is somewhat new, early data indicates its effectiveness. In a Deloitte 2021 survey, 80% of respondents reported that their organizations were either implementing or planning to implement dynamic risk management methods such as risk streaming and adaptive playbooks. The survey found that these organizations reported greater resilience and faster recovery times in the face of crises.4

Another 2021 study by Deloitte found organizations that invested in digital tools for risk management were better able to anticipate and respond to risk events. The study suggested that these firms were more likely to have a proactive risk culture and were better able to adapt to changing risk environments.5

Another study, conducted by EY, found that adaptive risk strategies were effective in improving organizations’ ability to detect and respond to risk events.6

In today’s business, dynamic risk streaming and adaptive playbooks are essential tools for risk management leaders. By fostering engagement, agility, and resilience, organizations can stay ahead of the curve and respond to risks with confidence.

Risk, resilience, and crisis leaders become coaches in the new arena of business agility, building up their team’s ability to absorb critical context, analyze it, and deploy a coordinated response.

Resilience coaches help organizations thrive by narrowing the list of scenarios to plan for and rehearse, orchestrating real-life scrimmages to assess the organization’s natural strengths, spotting areas for improvement and calculating risks, and breaking down important gaps and opportunities into fundamentals. These practices build muscle memory for resilience.

The cycle of practicing fundamentals, scenario planning, simulation and wargames, and reflection improves organizational resilience by both bolstering and bridging the gap between a firm’s potential performance and business-as-usual capability, termed the “functional reserve”.

Risk, resilience, and crisis leaders become coaches in the new arena of business agility, building up their team’s ability to absorb critical context, analyze it, and deploy a coordinated response.

Resilience coaches help organizations thrive by narrowing the list of scenarios to plan for and rehearse, orchestrating real-life scrimmages to assess the organization’s natural strengths, spotting areas for improvement and calculating risks, and breaking down important gaps and opportunities into fundamentals. These practices build muscle memory for resilience.

The cycle of practicing fundamentals, scenario planning, simulation and wargames, and reflection improves organizational resilience by both bolstering and bridging the gap between a firm’s potential performance and business-as-usual capability, termed the “functional reserve”.

Reviewing the Gameplan

In summary:

- Efective risk management is crucial for any organization, and recent developments in the field have emphasized the importance of context, capability, and connectivity.

- Context, capability, and connectivity are brought to life through threat intelligence, wargaming and microsimulations, and adaptive playbooks.

- New models of threat intelligence not only leverage widely accessible threat feeds, but empower teams to augment this data.

- By incorporating deliberate practice into risk and crisis response training, organizations can build the muscle memoryto handle unexpected challenges.

- Dynamic risk streaming and adaptive playbooks are an in-the-moment and integrated approach to managing risk. These strategies involve real-time monitoring of emerging risks and the use of predesigned strategies that can be quickly adapted to changing circumstances.

- By engaging the whole organization in these processes, organizations can build a culture of agility and adaptability that is essential in today’s fast-paced business environment.

The Playbook for Agility

Check out iluminr’s Resource Library to learn more

Sources:

- Ponemon Institute, Cost of Data Breach Report

- Accenture, State of Cybersecurity Resilience 2023,

https://www.accenture.com/us-en/insights/security/state-cybersecurity - Ericsson, K. A., Krampe, R. T., & Tesch-Römer, C. (1993). The role of deliberate practice in theacquisition of expert performance. Psychological Review, 100(3), 363-406.

- Cross, D. (2018), Cultivating excellence: The art, science, and grit of high performance in business.

- McKinsey, The resilience imperative: Succeeding in Uncertain Times

- Deloitte, Global Risk Management Survey – 12th Edition

- Deloitte, Putting Digital at the Heart of Strategy

- EY, Five Actions to Achieve Adaptive Risk Management