The steady increase in insurance costs on a global scale can be attributed to a confluence of factors that create a challenging environment for both insurers and insured.

In the evolving landscape of insurance, the role of insurers extends beyond underwriting and claims. They are embracing a new mission: preventing loss. With a proactive approach, insurers are now partnering with policyholders to identify and mitigate risks before they occur. By leveraging data, analytics, and innovative strategies, insurers are becoming valuable collaborators, working hand in hand with customers to safeguard against potential losses. This shift towards prevention marks an exciting era in insurance, where protection goes beyond financial reimbursement to actively safeguarding and preserving what matters most.

Navigating Crisis as Usual

One of the primary contributors to rising insurance costs is the escalation in claims. Insured companies are experiencing a growing frequency and severity of claims, leading to increased payouts for insurers. Factors such as changing societal attitudes, evolving legal frameworks, and the complexity of modern business operations have contributed to this trend.

- According to the Swiss Re Institute, insured losses from natural and man-made catastrophes reached $132 billion in 2022, making it one of the costliest years on record.

- The Insurance Information Institute reports that the number of natural disasters worldwide has been increasing, with a significant rise in weather-related events such as hurricanes, floods, and wildfires.

- A review by Allianz Global Corporate & Specialty found that the average value of large corporate insurance claims has been steadily increasing over the past decade, driven by factors such as higher litigation costs, increased reliance on technology, and the complexity of global supply chains.

To address this challenge, insured companies must implement robust risk assessment processes to identify potential vulnerabilities and develop mitigation strategies that minimize the occurrence and impact of losses. By proactively managing risks, insurers and the organizations they serve can demonstrate their commitment to risk reduction and potentially negotiate more favorable insurance terms.

Spiraling Cost

From the perspective of insurers and insured companies, inflationary pressures play a significant role in shaping insurance costs. The impact of inflation extends beyond the value of insured assets and encompasses the rising costs of materials, labor, and replacement parts. To effectively navigate this challenge, insurers and insured companies must collaborate and implement strategies that address the evolving dynamics of inflation and its implications on insurance coverage.

Insurers are acutely aware of the impact of inflation on insured assets and understand the importance of accurately valuing these assets. As inflation erodes the purchasing power of currency, insurers recognize the need to regularly reassess asset values to ensure that coverage limits remain adequate. By actively monitoring inflationary trends and engaging with appraisers and risk consultants, insurers can provide insured companies with more precise valuation assessments. This enables insurers to offer comprehensive coverage that aligns with the actual replacement costs of assets, reducing the risk of underinsurance and ensuring appropriate compensation in the event of a claim.

For insured companies, managing the impact of inflation requires close collaboration with insurers and a proactive approach to risk management. Insured companies must proactively communicate with insurers to share updated appraisals and assessments, enabling insurers to make informed decisions about coverage limits. Through ongoing dialogue, insured companies can ensure that their insurance coverage adequately addresses the impact of inflation and effectively protects their assets. This collaborative approach fosters a better understanding of the insured companies’ specific needs, allowing insurers to tailor coverage and offer solutions that are aligned with the evolving cost landscape.

Regular reassessment of insurance coverage is a shared responsibility between insurers and insured companies. Insurers need to provide the necessary tools and guidance to help insured companies navigate the complexities of inflation. This may include offering risk modeling techniques and data analytics that assess the impact of inflation on different aspects of coverage. Insured companies, on the other hand, should actively engage in reviewing their insurance policies, carefully analyzing coverage limits, deductibles, and exclusions in light of inflationary pressures. By actively participating in the insurance process, insured companies can identify potential gaps in coverage and work collaboratively with insurers to address them.

In addition to traditional insurance coverage, insured companies can explore innovative risk management strategies to mitigate the impact of inflation. This may involve considering alternative risk transfer mechanisms, such as captive insurance or self-insurance programs. These strategies empower insured companies to have greater control over their insurance costs and tailor coverage to their specific needs. By diversifying their risk management approach, insured companies can effectively address inflation-related risks and achieve a more comprehensive and resilient insurance program.

An Evolving Standard

Regulatory changes have a profound impact on insurance costs from the perspective of insurers and insured companies. As regulatory frameworks evolve to address emerging risks, enhance consumer protection, and ensure market stability, insurers and insured companies must adapt to new requirements and adjust their insurance coverage accordingly. These changes often result in increased costs for insured companies, as compliance with new regulations may necessitate additional coverage or higher limits.

For insurers, staying informed about regulatory developments is crucial. They must closely monitor changes in regulations, interpret their implications, and communicate effectively with insured companies. By proactively engaging in dialogue with insured companies, insurers can provide guidance on how regulatory changes may affect their insurance costs and help them navigate the complex landscape. This collaborative approach allows insurers to better understand the unique needs of insured companies and tailor their insurance solutions to align with regulatory requirements.

Insured companies should actively participate in the regulatory landscape and seek to understand the implications of regulatory changes on their insurance costs. By closely monitoring the evolving regulatory environment, they can anticipate potential adjustments to their insurance coverage and proactively plan for any associated costs. This includes assessing the impact of new regulations on their risk profile and engaging with insurers to explore options for optimizing coverage and managing costs.

One important aspect for insured companies is to identify regulatory incentives or risk mitigation measures provided by the regulatory frameworks. These incentives may include discounts or benefits for implementing specific risk management practices or demonstrating compliance with certain requirements. By leveraging these incentives, insured companies can optimize their insurance coverage and potentially reduce their insurance costs. This requires a proactive approach, with insured companies actively engaging with insurers and regulatory bodies to understand and take advantage of available opportunities.

Collaboration between insurers and insured companies is essential to effectively respond to regulatory changes and manage insurance costs. Through open communication, insurers can educate insured companies about the implications of regulatory changes, guide them in adjusting their coverage, and explore potential cost-saving measures. Insured companies, in turn, can provide valuable insights into their operations and risk profiles, enabling insurers to offer tailored solutions that meet regulatory requirements while optimizing coverage and controlling costs.

The Sea Change of Climate

From the perspective of insurance companies and insured companies, climate change presents significant risks that cut across industries and regions. The effects of climate change, including extreme weather events, sea-level rise, supply chain disruptions, and regulatory shifts, are increasingly impacting the operations and viability of businesses. As a result, insurers and insured companies must collaborate to effectively manage and adapt to these climate-related risks.

Insurance companies play a critical role in addressing climate risks by developing robust climate risk assessment tools. These tools enable insurers to evaluate the potential impacts of climate change on insured assets and assess the vulnerability of insured companies to climate-related events. By integrating climate data, historical weather patterns, and advanced modeling techniques, insurers can provide more accurate risk assessments, pricing, and coverage options tailored to the specific climate-related risks faced by insured companies. This allows insured companies to make informed decisions about their insurance needs and take proactive measures to mitigate climate risks.

To further support insured companies, insurers increasingly offer specialized climate-related insurance products. These products can include coverage for climate-related perils such as hurricanes, floods, wildfires, and business interruption due to extreme weather events. By providing comprehensive coverage specifically designed to address climate risks, insurers assist insured companies in managing the financial impact of climate-related incidents and enhancing their resilience. Such insurance products may also incentivize insured companies to adopt sustainable practices, as they often reward proactive risk mitigation measures and sustainable infrastructure investments.

Insured companies, on their part, need to actively engage with insurers to understand and manage the climate risks they face. This involves conducting thorough risk assessments and scenario analyses to identify potential vulnerabilities and develop appropriate risk management strategies. Insured companies should also prioritize sustainability initiatives, including measures to reduce greenhouse gas emissions, enhance energy efficiency, and promote resource conservation. By implementing sustainable practices, businesses can mitigate climate risks, potentially reduce insurance premiums, and enhance their long-term sustainability.

Collaboration between insurers, insured companies, and policymakers is vital to effectively address the challenges posed by climate change. Insurers can actively engage with policymakers to advocate for measures that incentivize climate resilience, such as the development of climate-friendly regulations, tax incentives for sustainable investments, and the integration of climate risk assessments into building codes and land-use planning. This collaboration ensures that policy frameworks align with the needs and realities of insured companies, facilitating a supportive environment for climate risk management and adaptation.

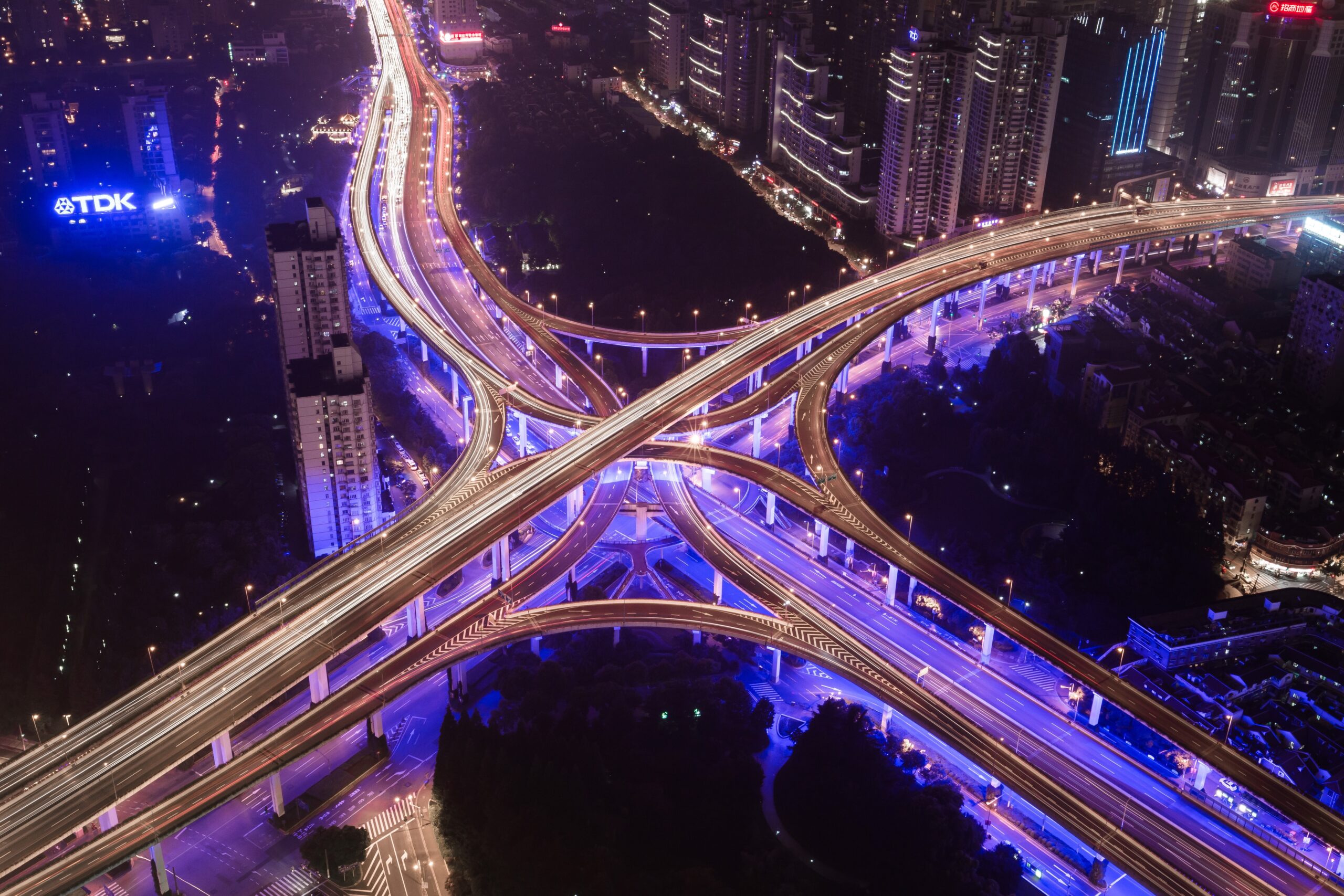

A World in Constant Flux

Geopolitical shifts, characterized by trade disputes, regulatory changes, and political instability, have become increasingly influential factors affecting insured companies operating in global markets. From the perspectives of both insurers and insured organizations, it is crucial to closely monitor geopolitical developments and proactively address the potential implications they may have on business operations and risk exposures.

Beyond geopolitical risks, societal changes also pose emerging risks that demand attention. Insured companies need to monitor shifts in social attitudes, cultural norms, and consumer expectations to identify potential risks and adapt their strategies accordingly. By fostering a culture of risk awareness and adaptability, organizations can proactively respond to emerging risks and seize new opportunities that arise from societal changes. This requires continuous monitoring of social trends, engaging with stakeholders, and maintaining open lines of communication with insurers to align risk management efforts.

Insured companies need to actively assess the potential impacts of geopolitical shifts on their supply chains, market access, and regulatory compliance. This entails conducting comprehensive risk assessments that take into account political and regulatory landscapes in target regions. By understanding the specific risks associated with geopolitical shifts, companies can develop contingency plans to mitigate potential disruptions. Diversifying supply chains is one effective strategy to reduce vulnerability to geopolitical uncertainties. By spreading production facilities and sourcing options across multiple countries, insured companies can minimize the impact of trade disputes, tariff changes, or regulatory shifts in a single jurisdiction.

Insurers are developing specialized insurance products that address geopolitical risks faced by insured companies. Political risk insurance, for instance, can offer coverage against government actions, contract breaches, political violence, and expropriation of assets. By obtaining political risk insurance, insured organizations gain an added layer of protection and financial stability in the face of geopolitical uncertainties. Insurers can also provide risk consulting services to help insured companies evaluate and manage geopolitical risks effectively. This includes assessing the political stability of target markets, analyzing regulatory frameworks, and providing guidance on risk mitigation strategies.

Building strong relationships with local partners and stakeholders is another essential aspect of managing geopolitical risks. Insured companies can benefit from local expertise and networks that can navigate complex political and regulatory environments. Establishing partnerships with trusted local entities, such as suppliers, distributors, or consultants, can provide valuable insights into the geopolitical landscape, enhance risk management capabilities, and foster resilience in times of uncertainty. Insurers can play a supportive role by connecting insured companies with their extensive networks and providing access to risk management resources.

Collaboration and information sharing between insurers and insured companies are crucial in addressing geopolitical risks. Insurers can leverage their expertise and global presence to provide insights on emerging geopolitical trends and potential risks. Through ongoing dialogue, insurers can better understand the specific needs and concerns of insured organizations, tailor insurance solutions to mitigate geopolitical risks, and ensure effective risk transfer. Insured companies, in turn, should communicate their risk management strategies, geopolitical assessments, and evolving business plans to insurers. This transparency allows insurers to offer customized coverage and risk management advice that aligns with the insured companies’ objectives and risk profiles.

The Double-Edged Sword of Technology

Emerging risks, such as cyber threats and technological disruptions pose unique challenges for insurers and insured companies. As these risks continue to evolve and gain prominence, it is imperative for both parties to adopt proactive and adaptable approaches to effectively manage and mitigate these emerging risks.

Insurers play a critical role in addressing emerging risks by developing specialized insurance products that specifically target these evolving challenges. By understanding the nature and scope of emerging risks, insurers can design coverage options that provide comprehensive protection for insured companies. For instance, cyber insurance policies can safeguard organizations against cyberattacks, data breaches, and other technology-related risks. Insurers should collaborate closely with insured companies to assess their vulnerabilities and tailor insurance solutions that adequately address their specific needs. This partnership enables insurers to gain deeper insights into the insured companies’ operations, emerging risk exposures, and risk management strategies.

This coverage, however, is increasingly difficult to attain without demonstrated prevention and preparedness measures. Insured companies must recognize the significance of emerging risks and actively prioritize investments in risk mitigation measures. Insured organizations need to implement robust cybersecurity measures, such as firewalls, encryption, regular vulnerability assessments, and employee training programs. By adopting a comprehensive cybersecurity framework, companies can reduce their vulnerability to cyber threats and protect sensitive data. Additionally, embracing innovative technologies can help organizations stay ahead of technological disruptions and leverage them to their advantage. Insured companies should invest in research and development to identify emerging risks associated with their industries and adapt their business models accordingly.

Collaboration between insurers and insured companies is vital in addressing emerging risks effectively. Insurers should serve as strategic partners, offering risk assessment services, risk mitigation recommendations, and guidance on emerging risk management. Through regular dialogue and information sharing, insurers can help insured companies identify and evaluate emerging risks specific to their industries, thus enabling proactive risk management strategies. Insured companies should actively engage with insurers, share their insights on emerging risks, and work together to develop customized risk management approaches that address their evolving needs.

A Way Forward

Technological advancements have revolutionized the insurance industry, presenting insurers and insured companies with exciting opportunities to enhance risk management, resilience, and insurance practices. These advancements, including insurtech solutions, data analytics, artificial intelligence (AI), and blockchain technology, offer transformative capabilities that can improve various aspects of the insurance value chain.

Insurtech solutions have emerged as a driving force behind innovation in the insurance sector. These technologies leverage digital platforms, mobile applications, and advanced analytics to streamline processes, enhance customer experience, and improve risk assessment. For example, telematics devices installed in vehicles can gather real-time data on driving behavior, allowing insurers to tailor premiums based on individual risk profiles. This integration of technology with insurance practices enables insurers to offer more personalized coverage options while empowering insured companies to make informed risk management decisions.

Data analytics and AI play a crucial role in augmenting risk assessment and underwriting processes. By leveraging vast amounts of structured and unstructured data, insurers can gain deeper insights into risk profiles, identify emerging trends, and refine their underwriting models. For instance, machine learning algorithms can analyze historical claims data, weather patterns, and socio-economic factors to predict future risks more accurately. Insured companies can also utilize data analytics to assess their own risk exposures, identify potential vulnerabilities, and implement targeted risk mitigation strategies.

Blockchain technology has the potential to revolutionize insurance by enhancing transparency, security, and efficiency. It enables secure and immutable record-keeping, simplifies the claims process, and facilitates smart contracts. Insured companies can benefit from the increased transparency provided by blockchain, reducing fraud risks and streamlining claims settlement. Additionally, blockchain-based platforms can enable insured companies to track and verify the provenance of goods throughout the supply chain, mitigating risks associated with counterfeiting, theft, or quality control.

Embracing digital transformation and leveraging innovative technologies not only enable organizations to address emerging risks but also enhances their competitive edge. By harnessing the power of technology, insurers and insured companies can improve customer engagement, streamline operations, and unlock new market opportunities. For instance, the use of chatbots and virtual assistants can enhance data collection, customer service and provide instant support, while mobile apps facilitate seamless policy management and claims filing.

Leveraging technologies like iluminr in developing a culture of resilience is crucial for both insurers and the insured. These technologies put into action the myriad of data available, helping companies navigate the challenges posed by rapidly shifting global dynamics. This involves fostering risk awareness throughout the organization, promoting proactive risk mitigation measures, establishing comprehensive training programs, and providing support for greater agility in fast-moving and complex change. Insurers can provide resources and guidance to insured companies on developing robust crisis management protocols, conducting risk assessments, and implementing adaptive response plans. By embedding resilience into their organizational DNA, businesses can adapt swiftly to disruptions, minimize losses, and maintain long-term sustainability of their business operations.

Toward Greater Sustainability of an Interconnected World

The convergence of global dynamics presents both challenges and opportunities for insurers and insured companies. By integrating risk, resilience, and insurance efforts in a holistic manner, organizations can effectively respond to rising insurance costs, climate change impacts, geopolitical shifts, and emerging risks. Collaboration, strategic adaptation, embracing technology, and fostering a culture of resilience are key pillars for navigating the evolving global landscape, mitigating risks, protecting assets, and promoting long-term sustainability in an interconnected world.

Author

Paula Fontana

VP, Global Marketing

iluminr